Economics

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

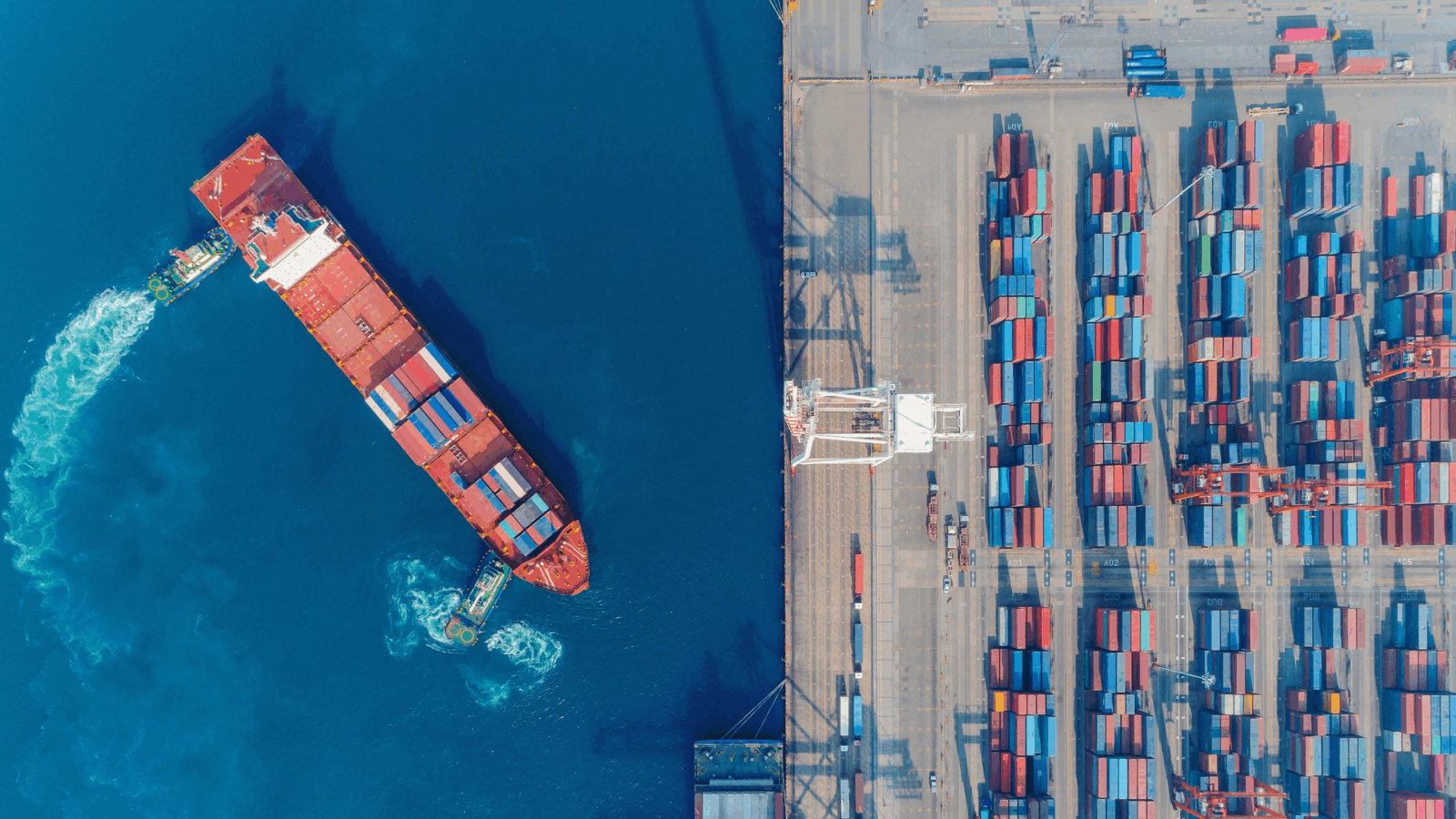

Boy, Oh Boycott: Can Canada’s ‘Buy Canadian’ Movement Actually Dent the US?

Photo illustration by Connor Lin / The Daily Upside, Photos by Photka and Koosen via iStock